How to Avoid the 7 Biggest Classification Mistakes for Exempt Employees

Expertise provided by Janice Morreira, BBSI HR Consultant and Freddie Luzod, BBSI Payroll Specialist

When it comes to classifying employees as exempt or non-exempt, it's more complicated than making them salaried to avoid overtime. If you aren't aware of the nuances involved in classifying exempt employees, you may end up facing significant fines and penalties, as well as damage to your company's reputation. We'll discuss the most common and costly mistakes employers make when classifying exempt employees, so you can avoid them.

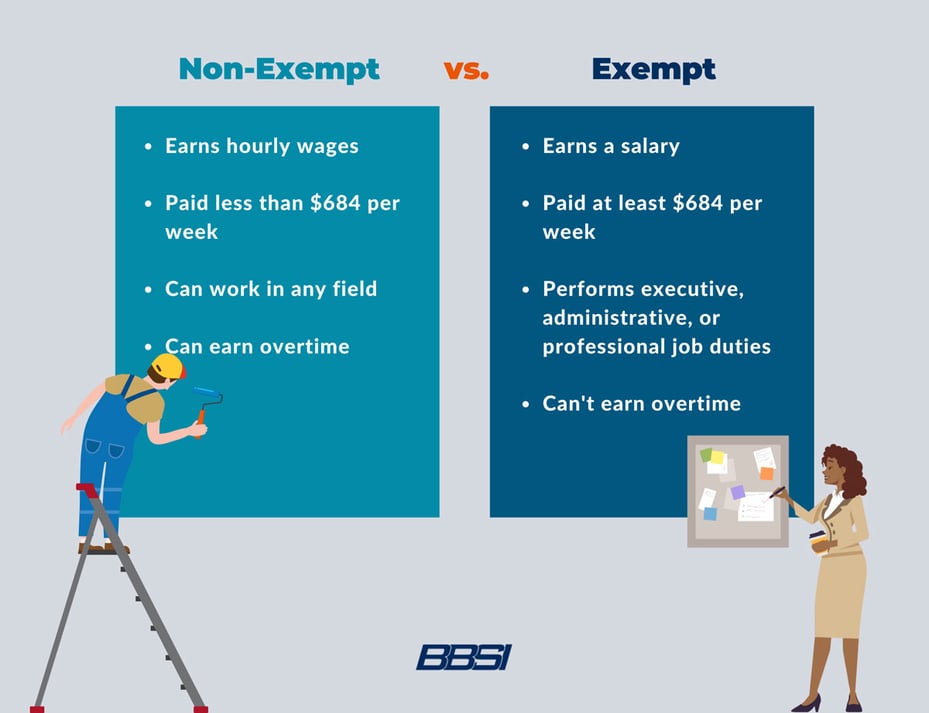

The Difference Between Exempt and Nonexempt Employees

Exempt employees are not eligible for overtime pay. They're usually professionals, outside salespeople, or fall under another exempt status category. Non-exempt employees are protected under the federal Fair Labor Standards Act (FLSA) and must be paid at least minimum wage plus overtime for working more than 40 hours a week.

Why are Mistakes with Exempt Employees Common?

Employers who want to avoid paying overtime may misclassify a non-exempt employee as exempt. Because the FLSA is designed to protect employees from unfair labor practices, exempt employees must meet specific standards. Oftentimes an employers’ biggest mistake is classifying an employee who does hourly-wage work as exempt.

What are the Ramifications of Making Mistakes with Exempt Employees?

Legal Penalties

Employee misclassifications are a federal violation, and you can be fined up to $10,000 and face time in prison. Each state has its own regulations that may also include fines. Civil fines can be up to $1,000 per violation. On top of potential criminal penalties, misclassified workers can sue for up to three years of back pay and legal fees. The court can also award damages up to double this amount.

Damage to Morale and Reputation

In addition to the legal and financial backlash, misclassified employees can take a toll on your company’s overall culture and reputation. Misclassified employees may not understand their true roles or level of authority regarding decision-making and managing other employees. Whatever the case, this miscommunication can lead to confusion and damage to morale. When you misclassify an hourly employee, you may deny them money they’re entitled to, time off, and possibly even benefits. Your business can become known for exploiting employees and, consequently, have trouble hiring qualified talent.

How Do You Determine if an Employee Is Exempt?

Employees can be classified as exempt based on their compensation structure, job duties, and how much freedom they have to carry out their duties. Exemption generally only applies to professional roles filled by employees with specialized knowledge and expertise.

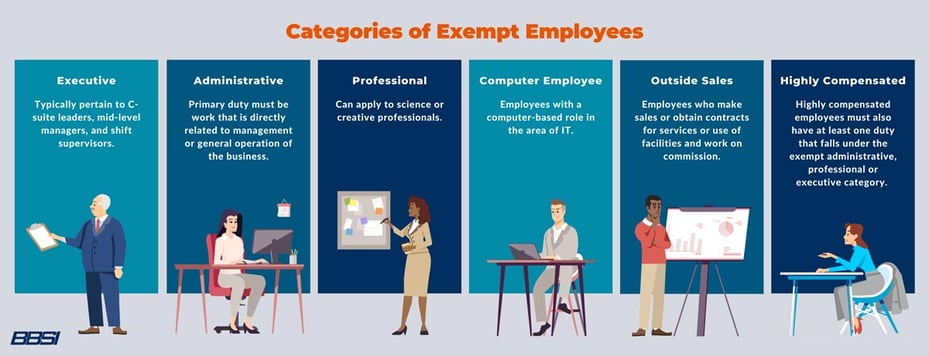

Categories of Exempt Employees

There are six broad categories of white-collar workers that can be categorized as exempt. Blue-collar workers and manual laborers cannot be classified as exempt, no matter how skilled or highly paid. For instance, crew leaders who supervise work crews but also help do the work can't be classified as exempt.

Executive

Executive roles typically pertain to C-suite leaders, mid-level managers, and shift supervisors. To qualify for an executive exemption, an employee must meet the following qualifications:

- Primary duty is managing a department or the entire company, including at least two or more other full-time employees

- Can hire, fire, or promote employees directly or has significant influence over the hiring, firing, or promoting process

Read: The Employee Lifecycle: From Hiring to Retirement

Administrative

The administrative role is one of the more challenging classifications to define. The DOL issued an opinion letter outlining some essential elements of determining whether an employee qualifies for an administrative exemption. The qualifications for an administrative exemption include:

- Primary duty must be work that is directly related to management or general operation of the business

- Able to exercise independent judgment and discretion

- Duties require advanced knowledge and are not manual in nature

Professional

The professional category exemption can apply to science or creative professionals.

Learned Professional (Field of Science)

The learned professional exemption applies to highly trained professionals in the fields of science and engineering. The employees must meet the following criteria:

- Primary duty consists of work that requires advanced knowledge in their field and is predominantly intellectual

- Must have obtained specialized instruction to perform their duties

Creative Professional

Employees that are eligible for the creative professional exemption must:

- Perform primary duties requiring invention, imagination, originality, or talent in a recognized creative or artistic field.

Computer Employee

Employees with a computer-based role may be exempt if they meet the following requirements:

- Primary duties are in IT, such as a computer systems analyst, computer programmer, software engineer, or other similarly skilled workers in the computer field

- Primary duties include application of system analysis techniques and procedures, design, development, documentation, analysis, creation, testing, or modification of computer systems or machine operation systems

Outside Sales

Employees that perform outside sales may be exempt if they:

- Work on commission

- Primarily work making sales or obtaining contracts for services or use of facilities

- Primarily work away from the employer’s business locations

Highly Compensated

Highly compensated employees must also have at least one duty that falls under the exempt administrative, professional or executive category. These employees are:

- Typically owners

- Perform office or non-manual work

- Paid a total annual compensation of $107,432 or more, including at least $684 per week paid on a salary or fee basis

Salary Requirements for Exempt Employees

In addition to the job duties listed above, exempt employees must be paid a minimum salary. Some states have additional salary requirements, while some abide by federal regulations. The minimum federal salary requirement for exempt U.S. workers is:

- Weekly salary of $684 per week, or an annual salary of $35,568 per year

California's salary requirement for exempt workers is at least twice the state's minimum wage. What is the minimum wage in California? For employers with 25 or fewer workers, the minimum wage in California is $15.50 per hour. The rate stays the same for employers with 26 or more employees at $15.50 per hour.

What are the Most Common or Costly Mistakes for the Classification of Exempt Employees?

There are several common mistakes that employers make in the classification of exempt employees, including:

#1. Unclear Job Descriptions

Before you hire someone, you should know whether their role is exempt or non-exempt and the job description should explicitly state the classification. This avoids any confusion on both sides. For instance, blue-collar companies rarely have any exempt positions. If you are hiring an exempt employee, make sure the job description clearly falls into one of the exempt categories.

#2. Failing to Ensure Compliance with State Requirements

You should always double-check state salary requirements. Some states, such as California, have stricter requirements than at the Federal level. To make sure you are offering enough compensation to exempt employees, you need to know the state, city, and county salary requirements, since these may differ from federal requirements.

#3. Not Abiding by the Duties Test

A lot of employers assume all managers are exempt. However, in addition to managing at least two full-time employees, managers have to meet the duty and salary requirements listed above to be exempt. Always use an employee's category, job duties, and salary to determine if they're exempt or not.

#4. Not Realizing the Ramifications of Making Someone Exempt

Some employers only look at the positives of making an employee exempt, such as avoiding overtime pay. However, you must also consider that exempt employees will have certain freedoms and flexibility non-exempt employees. For example, exempt employees can take a few hours off to go to a doctor’s appointment or pick their child up from school and still get paid for the day. Partial days are still paid in full and don't count as sick or vacation days. You may even end up with employees who take a call while they're on vacation and consider it as a working day.

#5. Making Employees Exempt that Have to Fill a Specific Task in a Set Time Frame

Jumping off of #4 above, if an employee has to finish a certain task within a specific time frame, but they’ve been misclassified as exempt and given extra flexibility, they may not meet their deadlines. Similarly, you may not have much recourse if an exempt employee frequently leaves early.

#6. Giving Exempt Status to Untrustworthy or Immature Employees

As previously mentioned, exempt employees have a lot more flexibility than hourly employees. Because of this, you should seriously consider only giving mature employees exempt status to avoid the abuse of more flexibility. Part of being exempt is working until the job is done, and some employees may not be trustworthy enough to do that.

#7. Not Verifying Where Remote Employees Live Annually

Due to the pandemic, many companies have moved their staff to remote work. While this can be beneficial for employees and employers alike, it's important to verify where your remote workforce lives to make sure you follow their local regulations. Your employees may not update you if they’ve moved, so it’s essential to have your employees verify their address at least annually. You may also find an employee moved to a less restrictive state, allowing you to follow less strict standards if you choose.

How BBSI Can Assist with Managing Exempt vs Non Exempt Employees

If you have exempt employees, you need to stay on top of wage and labor laws related to exemptions. Labor laws change every few years, so it's critical to stay up to date.

To ensure compliance with rapidly changing labor laws, you should consider seeking help from professionals such as BBSI. BBSI’s HR Consultants offer a wealth of expertise about new regulations and legislation to help you stay on top of updates that can impact your business. Reach out to our team today to learn how we can help your business flourish.

Disclaimer: The contents of this white-paper/blog have been prepared for educational and information purposes only. Reference to any specific product, service, or company does not constitute or imply its endorsement, recommendation, or favoring by BBSI. This white-paper/blog may include links to external websites which are owned and operated by third parties with no affiliation to BBSI. BBSI does not endorse the content or operators of any linked websites, and does not guarantee the accuracy of information on external websites, nor is it responsible for reliance on such information. The content of this white-paper/blog does not provide legal advice or legal opinions on any specific matters. Transmission of this information is not intended to create, and receipt does not constitute, a lawyer-client relationship between BBSI, the author(s), or the publishers and you. You should not act or refrain from acting on any legal matter based on the content without seeking professional counsel.