A Guide to 401(k) Programs From an HR Business Partner

One of the best ways for a business of any size to attract and retain talent is a robust benefits package. One of the most essential benefits that job seekers are looking for in 2022 is a 401(k) retirement plan, as it's a key pathway for Americans to save for retirement.

According to the U.S. Bureau of Labor Statistics, 68% of Americans working for private companies have access to a 401(k) plan through their employer. In the public sector, that figure jumps to over 90%.

You're missing a critical attraction and retention incentive if your business does not offer employees a 401(k) plan. Here's a guide from an HR business partner, we explain 401(k) basics and best practices to follow when exploring 401(k) plans and offer tips for easy implementation within your small business.

TABLE OF CONTENTS

What is a 401(k) Program?

A 401(k) program is a retirement savings plan offered by an employer. It allows employees to save a portion of their paycheck, either pre-tax or after-tax (Roth), in a dedicated retirement savings account.

Employers can also contribute to their employees’ 401(k) plans. The employer's contribution is typically based on the employees’ contribution — also known as a match. From there, the employee’s account can continue to grow through investment earnings.

There are two basic 401(k) plans types: Traditional and Roth. These differ primarily in how they’re taxed.

- Traditional: Employee contributions are deducted from paychecks pre-tax, which reduces an employee’s overall taxable income. The funds will be taxed later at the time of fund withdrawal.

- Roth: Employee contributions to a Roth 401(k) are deducted from paychecks post-tax. Funds will not be taxed at the time of fund withdrawal.

Key 401(k) Definitions

As an HR business partner, we recommend you should understand a few key terms before exploring 401(k) plans.

Contributions

Contributions refer to any funds put into a 401(k) by an employee or their employer. Employees can contribute a specific dollar amount or percentage of their paycheck before taxes to lower their taxable income. Contributions can also be made after-tax.

Annual IRS limits are higher for 401(k)s than for Individual Retirement Accounts (IRAs), so employees can save more per year in a 401(k) plan than in an IRA. Their employer can also match a percentage of their contributions to help grow their savings. This is referred to as employer matching.

Employer Matching

Employer matching is when an employer contributes a certain amount to their employees’ retirement savings plan based on the amount of each individual employee’s annual contribution. In addition to contributing money, employers can elect to make annual profit-sharing contributions.

Profit-Sharing Contribution

A profit-sharing contribution is a pre-tax 401(k) contribution an employer makes after year-end. This end-of-year contribution is tax-deductible for employers for the previous year.

Since it’s made at year-end, it offers employers an opportunity to take their time and assess company finances before determining how much they’d like to contribute.

Investments

After enrollment, employees can select investments from a group of available mutual funds. Typically, the investment lineup includes a combination of money market, bond, stock, index, and target-date funds.

Offering this variety of investment options helps support employees’ varying retirement goals, risk tolerances, and expected retirement dates.

Ownership

After a certain amount of time, employees will vest (own) the total value of their account, including employee contributions, employer matching contributions, and any subsequent interest earnings. However, ownership of employee contributions is always 100% vested.

Vested

Being “vested” in a retirement plan means an employee owns a percentage of their account in the plan each year. An employee who is 100% vested in their 401(k) balance means they own 100% of the funds and their employer can’t reclaim it for any reason.

Withdrawals

Since a 401(k) is designed to help employees save money for retirement, withdrawal requirements are strict. Employees must be at least 59.5 years old or meet other specific criteria to withdraw funds.

Any withdrawal that doesn’t meet these requirements will incur a 10% penalty tax. The employee will also be required to pay any applicable income tax on the withdrawal for qualifying events, like covering higher education expenses if the plan allows hardship withdrawals.

Compliance

A 401(k) is a ‘qualified’ retirement plan, meaning it’s eligible for unique tax benefits under IRS guidelines. It is governed by ERISA (the Employee Retirement Income Security Act of 1974), a federal law that sets guidelines and standards for retirement plans.

Regardless of your industry, every 401(k) plan must comply with IRS and ERISA rules and regulations.

How Do 401(k) Programs Work?

The administration of a 401(k) entirely depends on the employer acting as a plan sponsor.

As a plan sponsor, each employer is responsible for maintaining compliance with ERISA and IRS guidelines, determining eligibility, overseeing plan maintenance, and hiring outside service providers (such as an administrator or investment consultant) to ensure the plan is performing as expected for employees.

From an HR Business Partner: Here's How Do You Know if a 401(k) Program is Right for Your Organization?

As a small business, it is challenging to determine when to set up a 401(k) program for your employees. In the early days of a business, most owners and managers are too busy keeping the business afloat to think about long-term employee benefits.

But as your business expands and becomes more stable, implementing a 401(k) program to improve employee benefits is a great way to facilitate growth, attract new talent, and boost employee retention.

Here are a few different signs the time is right to offer a 401(k) program to your employees.

- You have at least ten employees

- You’re preparing your business for growth

- Your industry is becoming more competitive

- You want to make employer contributions to help your employees prepare for the future

- You want to attract and retain high-quality talent

Why Businesses Should Prioritize Retirement Benefits in 2022

Going into 2022, employees ranked a competitive retirement program as one of their most valued employer benefits. Given its popularity, many businesses are realizing that offering retirement benefits is essential to remaining competitive in today’s hiring landscape.

Hiring isn’t the only area where 401(k) plans can make a difference. Here are a few more reasons why employers should prioritize retirement benefits.

Financial Stress Hurts Employee Productivity

According to research from Willis Towers Watson, nearly two in five employees live paycheck-to-paycheck. This situation isn’t limited to employees living at a lower income level – even high-paid employees can struggle financially.

The survey of 8,000 employees conducted in 2020 found that:

- 39% could not cover an unexpected $3,000 expense if the money were needed within the next month

- 18% of employees making more than $100,000 annually live paycheck-to-paycheck

- 70% are not hitting their retirement savings goals

- 32% are negatively affected by financial problems

This financial insecurity affects every aspect of their daily lives, including productivity and engagement at work. According to the same research, 39% of struggling employees reported that money concerns kept them from performing their best while at work.

A further 49% said their financial situation caused stress, anxiety, and depression. While these factors can hugely impact employee productivity and performance, they can also have other consequences, such as higher healthcare costs.

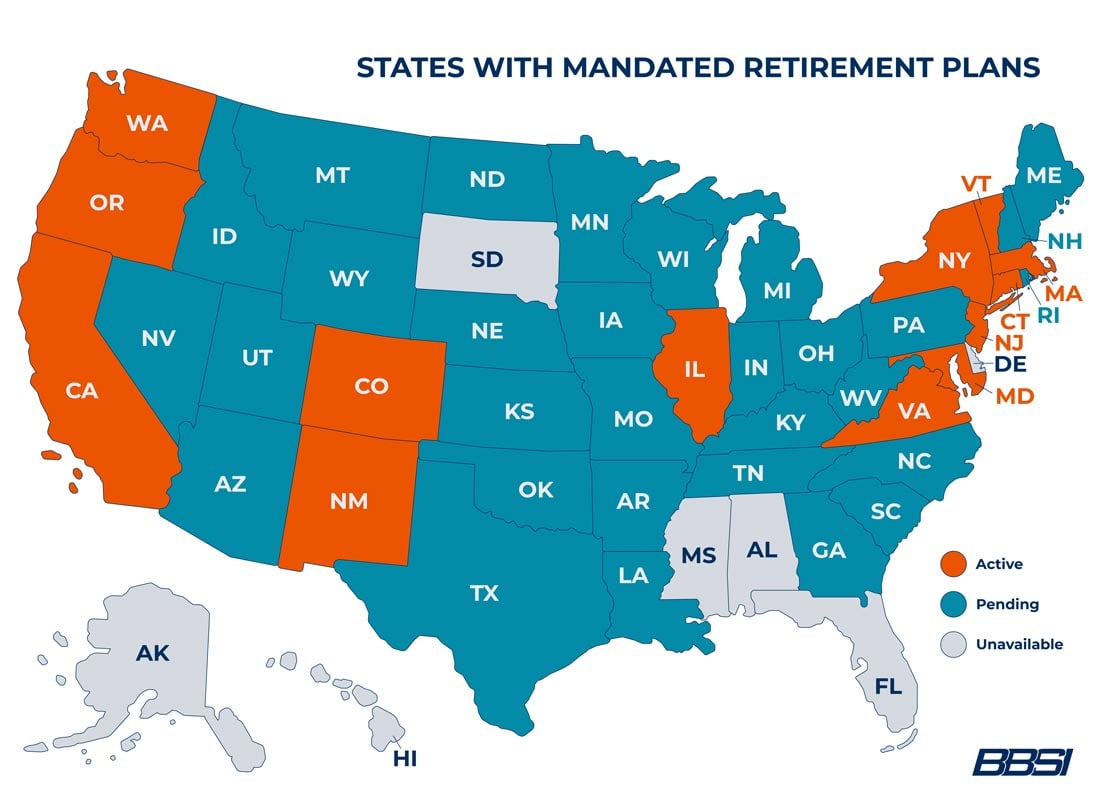

The Rollout of State-Mandated Plans

Employer-sponsored 401(k) plans are often a better alternative to new, state-mandated plans rolling out across the United States.

These state-mandated retirement plans have been in the works for years and are starting to take effect. Of the 30 states considering mandated employee retirement benefits, 13 have passed legislation.

Most state-sponsored retirement plans do not enable employees to save significant amounts for their retirement. These state plans are more like personal IRAs, which only enable savings of $6,000-7,000 in an average year.

Most state-sponsored retirement plans do not enable employees to save significant amounts for their retirement. These state plans are more like personal IRAs, which only enable savings of $6,000-7,000 in an average year.

In contrast, a 401(k) retirement plan enables employees to save between $20,500 and $27,000 per year. These higher contributions make a massive difference in an employee’s retirement savings.

A tip straight from an HR business partner: Once state-mandated plans take effect, non-compliance will cause significant issues for business owners. Businesses should take action quickly to implement their own 401(k) plans before employees are presented with a less-effective retirement plan option.

The Challenges of Implementing a 401(k) Program

Businesses will likely face the following challenges when implementing a 401(k) program:

Administrative Burden

A 401(k) administrator is tasked with managing an employer’s retirement plan, which comes with a long list of responsibilities and liability risks. Typically, this administrator is either an internal staff member or hired from a third-party company.

Regardless of their classification, the administrator has a wide variety of responsibilities, including:

- Consultation on initial plan design

- Preparation of Summary Plan Description for participants and beneficiaries

- Approval of transactions (loans, distributions, etc.)

- Monitoring compliance with plan rules and federal regulations

- Discrimination testing and audit support

- Compliance filing (Form 5500, Safe Harbor notices, Form 1099-R)

- Generation of annual participant census

- Day-to-day employee communication

From setup to maintenance, any 401(k) program comes with a slew of reporting, recordkeeping, and compliance requirements that can increase an organization’s overall administrative burden.

Annual Non-Discrimination Testing

Any 401(k) program must undergo annual non-discrimination testing — an evaluation designed to ensure that any business’s 401(k) program benefits employees equally. This test is mandated by ERISA and is enforced by government agencies like the IRS and the Department of Labor.

To help avoid these intense compliance and testing requirements, many businesses implement a 401(k) program known as a safe harbor plan. This type of plan ensures every eligible employee receives a contribution from their employer and prevents situations where only key employees utilize the plan. If a business has implemented a safe harbor 401(k) plan, they are exempt from annual non-discrimination testing as long as this plan remains active.

There are a few types of safe harbor plans, but all make employer contributions mandatory with immediate fund vesting. The contributions might be an expense to the company, but they’re an expected amount and allow the company to skip annual nondiscrimination testing.

The Benefits of Offering a 401(k) Program

There are many advantages for small businesses that offer a 401(k) plan to their employees.

Attract and Retain Valuable Employees

If an employer doesn’t offer retirement savings opportunities, it can be a significant red flag to potential new hires. In light of the changing expectations brought on by the Great Resignation, many job seekers expect not only a 401(k) plan but an employer contribution as well.

There are benefits to this approach for employers as well as employees. Employees investing in their future through retirement plans may be less likely to move on to other companies. When employers make matching contributions or provide additional value, it adds to an employee's total compensation.

Improve Employees’ Financial Wellness

If financial stress can damage the fabric of your organization, financial wellness can help repair that damage. According to one employee survey, 74% of employees list financial wellness programs as a critical workplace benefit. Another 60% said they would be more likely to stay with an employer who offered these benefits.

While many employees invest outside of work, 401(k) plans are still one of the most popular long-term savings vehicles.

Receive Tax Credits

In addition to offering tangible retention and employee wellness benefits, there are financial and tax-related incentives for businesses that provide 401(k) plans. These incentives include:

Tax Credits For Employer-Sponsored Contributions

Employers who report match and profit-sharing contribution amounts on their business taxes will get a credit. As long as they don’t exceed the limit set out by the IRS, businesses can deduct this amount on federal income tax returns.

Deductions for 401(k) Plan-Related Expenses

In the past, only businesses with fewer than 100 employees were eligible to receive a tax credit for expenses associated with implementing a 401(k) plan. The recent passage of the SECURE Act 2.0 increases the maximum available credit significantly, from $500 per year for the first three years to $5,000 per year, up to a maximum of $15,000.

Reward Employees with Profit-Sharing Contribution

Rewarding employees with profit-sharing is another way to show your team how much they’re valued. There are a few different ways to approach profit-sharing within your 401(k) plan.

Pro-rata: The employer gives every employee the same percentage or flat amount.

New comparability: Every employee is classified into diverse categories, then each category is granted a unique amount based on their contribution, value, or time at the company.

Meet State and City Requirements

If you don’t offer an employer-sponsored qualified retirement plan, you will be required to enroll your employees in state-mandated plans automatically. If you provide an eligible employer-sponsored retirement plan, you are exempt from the state-mandated plans.

If your business chooses to go with a state-mandated plan, you are responsible for its administration. If mistakes are made, such as neglecting to submit payroll funding to the state or forgetting to enroll a new employee, your business is liable for substantial federal penalties and fines.

By running your own 401(k) program (with the help of an internal or external administrator), you can avoid these potential complications.

Receive Retirement Benefits as an Owner

Owners need retirement benefits too! A 401(k) plan is a great way to lower your taxable income and save for your own retirement if you own a profitable business. Keep in mind that this may be subject to nondiscrimination testing.

How to Set Up a 401(k) for Your Small Business

Setting up a 401(k) plan may seem intimidating, but the right advice and expertise can help make the process a lot simpler.

Here are a few steps to keep in mind as you move towards implementing a 401(k) retirement plan for your employees.

1. Determine Who Will Use the Plan

The first thing you’ll need to do when considering a 401(k) plan is determining who will use it. Will it just be the owners, family members, or highly compensated employees? Or will only your non-essential employees utilize it?

Determining plan usage is critical in guiding all subsequent implementation details, including non-discrimination testing.

2. Research Retirement Providers

Once you’ve determined who will use your 401(k) plan, you can start researching companies to provide administrative services for your program.

As you create your list, include a range of reputable mutual fund companies, insurance companies, and brokerage firms. The ideal candidate will serve both you and your employees with helpful resources and responsive customer service.

3. Select a Plan That Fits Your Business’ and Employees’ Needs

Earlier, we ran through a few of the different 401(k) plans available to small businesses today. These include:

Traditional 401(k)s: This is the most flexible plan, offering employers many options for matching, contributing on behalf of employees, or both. Robust compliance rules ensure these plans are beneficial for regular employees, as well as owners and managers.

Safe harbor 401(k) plans: These must provide for fully-vested employer contributions and, as a result, exempt the employer from many of the tax rules associated with traditional 401(k) plans.

Automatic enrollment 401(k) plans: Allows employers to automatically deduct a fixed amount from employee wages unless they actively opt-out. These automatic enrollment contributions qualify as elective deferrals.

SIMPLE 401(k) plans: These are straightforward, cost-effective plans available to small businesses (100 employees or fewer) that are not subject to the same non-discrimination testing as traditional 401(k) plans.

4. Adopt a Written Plan

Every business needs to have a written document outlining how its 401(k) program operates. Some aspects are prescribed by law, while others are unique to your organization.

Many organizations find the creation and maintenance of this document complex, so hiring a third-party financial institution or business consulting organization to help create your 401(k) plan may be best for your business.

5. Use Your Selected External Party to Set Up a Trust

Even if you choose to administer your 401(k) internally, your organization will eventually have to establish trust and accompanying records through an external party.

This trust ensures that paycheck deductions are accurate and timely. Trusts also protect against fraud, ensuring all assets are used solely to benefit plan participants and their beneficiaries.

6. Establish a System for Recording Employee Contributions

Every 401(k) plan requires an accurate recordkeeping system. This ensures accurate attribution of contributions and distributions and earning and loss tracking.

This recordkeeping system becomes a tool for your plan administrator to gather the information needed for annual reports they file with the federal government.

7. Communicate Plan Information and Benefits to Employees

You must notify eligible employees as you implement your 401(k) plan. Many organizations use an enrollment guide to help explain the taxation and savings benefits to their staff. Some send information via mail or email, while others produce video or audio resources. The choice is yours.

8. Incentivize Enrollment

Once employees understand the benefits of these retirement savings vehicles, most are eager to take advantage. If enrollment is slower than you’d prefer, you can work to boost enrollment with fun incentives like a raffle or prize drawing.

How BBSI Helps Businesses Implement 401(k) Program

Moving from contemplation to implementing a 401(k) plan is a big step. Many small businesses choose to take this step alongside an HR business partner like BBSI.

Providing a competitive retirement program to your employees is of the utmost importance to the BBSI team.

When we work together, BBSI assumes the role of the trustee, the plan sponsor, and the administrator, and manages all recordkeeping and administration for your business.

As the sponsor of your plan, we share fiduciary responsibility and can assist with everything from selecting investments to staying on top of compliance and legislation to help you meet state and federal mandates.

We’ve also partnered with Morgan Stanley and Milliman to offer a full-service MEP (multiple employer plan) retirement program, with many of the features typically only available to large corporate employers.

Contact your local branch today to learn more about how BBSI can help you implement and maintain a competitive retirement program for your business.

Disclaimer: The contents of this white-paper/blog have been prepared for educational and information purposes only. Reference to any specific product, service, or company does not constitute or imply its endorsement, recommendation, or favoring by BBSI. This white-paper/blog may include links to external websites which are owned and operated by third parties with no affiliation to BBSI. BBSI does not endorse the content or operators of any linked websites, and does not guarantee the accuracy of information on external websites, nor is it responsible for reliance on such information. The content of this white-paper/blog does not provide legal advice or legal opinions on any specific matters. Transmission of this information is not intended to create, and receipt does not constitute, a lawyer-client relationship between BBSI, the author(s), or the publishers and you. You should not act or refrain from acting on any legal matter based on the content without seeking professional counsel.