Payroll can be a burden for businesses due to its complexity, time-consuming administrative tasks, and the risk of costly errors. If you are struggling to balance payroll administration with your other responsibilities as a business owner, our payroll service can help.

With years of experience processing payroll for businesses of different sizes and industries across the country, your dedicated BBSI Payroll Specialist can help simplify your workload, keep you compliant, and protect your bottom line.

Avoid costly payroll processing mistakes and strategically streamline your payroll operations.

Ensure wage and tax law compliance and get the guidance you need when questions inevitably arise.

Maximize productivity by managing employee pay data and reporting from any device, anywhere.

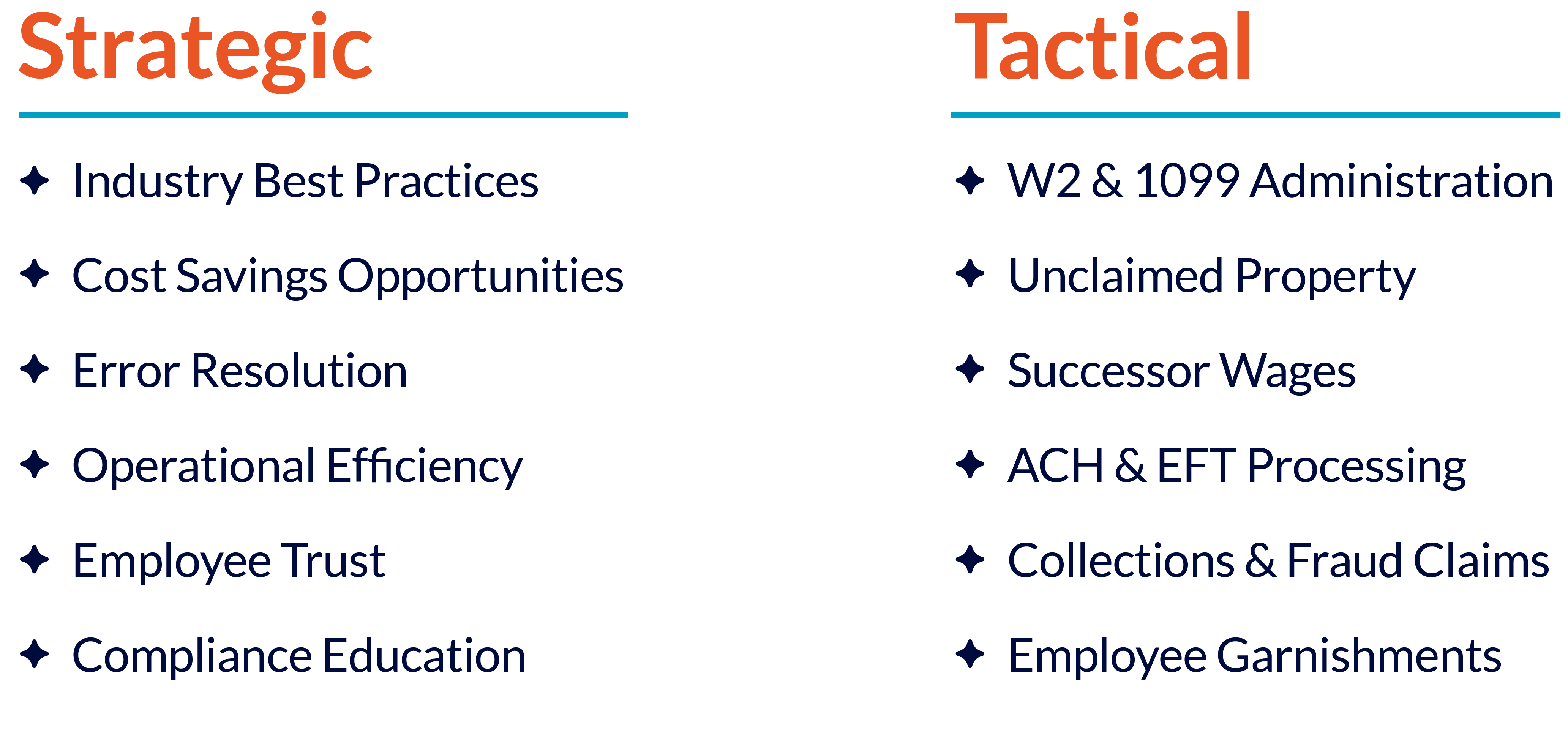

In addition to efficiently processing payroll, we’ll provide full-service strategic and tactical support to streamline your payroll operations and make your life easier.

Our payroll and HR software, myBBSI, allows you to efficiently manage payroll operations from your phone, tablet, or desktop. myBBSI streamlines end-to-end payroll processing, employee administration, and reporting, while also providing your employees with 24/7 access to paystubs from their personal device.

Wage laws, labor regulations, and tax requirements are complex and constantly evolving. Navigating these is challenging, especially for businesses with employees in multiple states, and non-compliance can lead to significant financial penalties.

Your BBSI Payroll Specialist is connected to a national network of BBSI branches, allowing them to utilize the collective intelligence of every BBSI Payroll Specialist in the country to accurately answer your questions and strategize when regulatory changes occur. Through this local and national support network, you’ll feel confident in the compliance of your payroll operations no matter where your business operates.

We have run our payroll through BBSI for a number of years now and no matter what problems I am having, our payroll manager would immediately address the issue, solve it and make my life so much easier.

Harriet C.

Servpro FranchiseeBBSI is wonderful to work with. They’re always there answering any questions I might have and ready to help with anything we need. They are the best when it comes to payroll, always reminding me to send it in and always helping me with any issues.

Carmen M.

Leawood HomesPayroll can sometimes be complicated, with garnishments, deductions for insurance, etc. BBSI almost always answers their phones the first time I call, and because they’re local, I can drop into their offices if I need to. I can even refer our employees directly to our ‘payroll department.'

Mark P.

Fish Window CleaningYour BBSI Payroll Specialist is committed to making sure your employees are paid efficiently, accurately, and on time, every time. They’ll help you document payroll processes, evaluate them for productivity and efficiency, and implement solutions to streamline payroll administration for you and your business.

BBSI processes payroll for thousands of employees each week, giving business owners like you time to focus on what matters most - the future of your company.

Outsourcing payroll allows you to leverage the expertise of a network of payroll professionals, rather than relying on one person to do it all. Spreading out this liability reduces the risk of costly errors and can help ensure compliance with complex wage and labor laws that differ from state-to-state. It also frees up valuable time and resources for you and your in-house team to focus on strategic activities, rather than getting bogged down by repetitive administrative tasks.

Every business has unique timekeeping needs, which is why we provide you with several solutions for tracking employee time and attendance. Whether you require physical time clocks or prefer your team utilize an app to clock in and out, we have a solution designed with your business and your team in mind.

Integrations with the myBBSI Payroll Portal, geolocation and geofencing features, biometric facial, fingerprint, and iris recognition, and job costing options work together to consistently provide accurate data that you can trust.

It’s common to confuse the difference between exempt employees, independent contractors, and non-exempt employees, but getting it right is critical to avoiding costly fines for your business. Your BBSI Payroll Specialist and HR Consultant will work together to help you classify employees correctly and ensure you are up to date on the latest exemption-related wage and labor laws.

Learn what reclassification may mean for your business and workforce. If you're operating in California and employ independent contractors, Assembly Bill 5 (AB5) likely applies to you.

Learn how Don O’Connor utilizes BBSI’s payroll and consulting services to eliminate inefficiencies and boost profit.

When you're looking for a partner to help you grow your business or process your payroll, you want someone local with an office in the neighborhood you can visit anytime, and who knows your name as soon as you walk in the door.